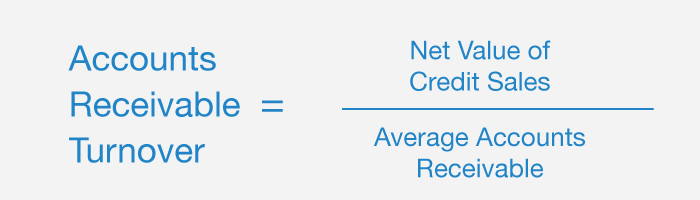

Net credit sales are the sales that are made on credit.Īccounts receivable does not include cash sales but only credit sales which are collected at a later date. The formula to calculate it is as follows:ĪRT = Net Credit Sales / Average Accounts Receivable It is used to measure the rate at which a company can collect its earnings from credit sales. The accounts receivable turnover ratio is a common investment analysis and accounting metric.

Accounts receivable turnover ratio how to#

How to Calculate Accounts Receivable Turnover Ratio However, as a rule of thumb, the higher the turnover ratio, the better the return prospects for the company.

As a result, they can't carry as high a debt load, meaning their AR turnover ratio should be higher. On the other hand, smaller companies often operate with tighter margins. Larger businesses can operate with lower ratios because they have more capacity to carry a high level of debt without impacting their cash flow. It is therefore vital to only compare turnover ratios of companies in like industries that have similar business models.įailure to do so may lead to an unreliable understanding of how high or low a company's ratio is or should be. Therefore, even among companies operating in similar industries, the ratio may not be comparable due to different business models. However, an important point to note is that different industries have different turnover ratios. It also means a lower working capital requirement, which significantly reduces the capital employed, thereby boosting its return on capital employed ( ROCE). On the other hand, the better a company is at collecting its debts, the sooner it can pay its expenses and reinvest in operations. This negatively impacts its liquidity as it does not have cash, rather only a claim on cash, which it cannot use to pay creditors and expenses or make purchases. This ratio is useful for several reasons. The lower a company's AR turnover ratio is, the longer and more difficult it is to collect from its debtors. More specifically, this metric shows how many times a company has turned its receivables into cash throughout a specific period. The account receivable (AR) turnover ratio measures a company's ability to collect money from its credit sales.

0 kommentar(er)

0 kommentar(er)